SOL Price Prediction: Bullish Technicals and Strong Fundamentals Support $217 Breakout Target

#SOL

- Technical Strength: Trading above 20-day MA with Bollinger Band breakout potential toward $217 resistance

- Fundamental Support: Alpenglow upgrade approval and institutional backing providing strong foundation

- Ecosystem Growth: Project Ascend and memecoin ecosystem development enhancing network utility and adoption

SOL Price Prediction

Technical Analysis: SOL Shows Bullish Momentum Above Key Moving Average

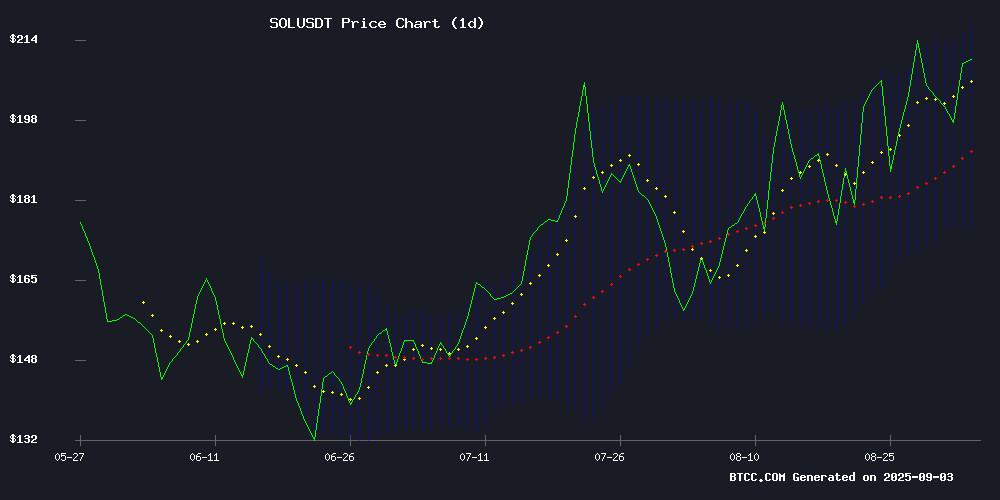

SOL is currently trading at $208.66, positioned above its 20-day moving average of $196.45, indicating underlying bullish momentum. The MACD reading of -10.67 remains in negative territory but shows improving momentum with the signal line at -8.55. The Bollinger Bands suggest SOL is trading NEAR the upper band at $217.39, with the middle band at $196.45 providing support. According to BTCC financial analyst James, 'The technical setup suggests SOL could test the $217 resistance level if it maintains above the $200 psychological support.'

Market Sentiment: Institutional Backing and Community Support Boost SOL Outlook

Recent news flow surrounding solana appears overwhelmingly positive, with multiple catalysts supporting bullish sentiment. The approval of the historic 'Alpenglow' upgrade with overwhelming community support, combined with institutional backing holding the $200 support level, creates a favorable environment. BTCC financial analyst James notes, 'The combination of strong technical fundamentals and positive news catalysts suggests institutional confidence remains intact despite short-term volatility.' The launch of Project Ascend to boost Solana's memecoin ecosystem further enhances the network's utility and adoption prospects.

Factors Influencing SOL's Price

Solana Holds $200 Support Amid Bullish Institutional Backing

Solana's resilience at the $200 mark underscores growing market confidence as the asset weathers August's volatility with modest weekly gains. Trading between $200.44 and $217.84, the consolidation phase is now seen as a potential springboard for upward momentum.

Institutional adoption reaches an inflection point with Solana-linked products gaining traction among major financial players. The network's Total Value Locked (TVL) surged 200% year-over-year to $34 billion, fueled by DeFi platforms like Kamino and Raydium.

WLFI Proposes Token Burn After Post-Launch Price Drop: What’s Next?

World Liberty Financial has unveiled a buy-back proposal aimed at curbing $WLFI's circulating supply and enhancing long-term token value. The move follows a 36% price plunge from $0.331 to $0.210 post-launch, with partial recovery to $0.229.

The plan would deploy liquidity pool fees from Ethereum, BNB Chain, and Solana networks to systematically repurchase and burn WLFI tokens. This mechanism directly ties token scarcity to platform usage while amplifying long-term holders' equity stakes.

Market observers note unusual trading patterns surrounding the debut, fueling speculation about potential insider activity. The proposal now faces governance scrutiny as traders weigh its efficacy against the token's volatile first-week performance.

Pump.fun Launches Project Ascend to Boost Solana Memecoin Ecosystem

Pump.fun has unveiled Project Ascend, a strategic initiative aimed at establishing itself as Solana's premier platform for sustainable memecoin projects. The September 2nd launch introduces Dynamic Fees V1 - a tiered pricing system that scales creator earnings with token performance, potentially increasing rewards by 10x.

The market cap-based fee structure reduces charges for successful projects while maximizing early-stage funding. "We need far more success cases," stated co-founder Alon Cohen in an audio message, emphasizing the need for tokens with lasting value that offer genuine retail opportunities.

This move comes as Pump.fun regains market dominance from competitor Bonkfun, according to Blockworks data. The dynamic fee model addresses previous limitations where flat rates discouraged whale participation and constrained project growth.

Leaked Data Reveals Crypto “Organic” Buzz Is Often Bought

A leaked spreadsheet has exposed widespread undisclosed paid promotions in the crypto influencer space, raising concerns about market manipulation. Over 200 influencers were contacted to promote an unnamed token, with fees ranging up to $60,000 per post. Fewer than 5% of the 160+ confirmed deals included proper advertising disclosures.

The tiered rate sheet reveals top influencers commanding five-figure sums for single promotions on platform X. Mid-tier accounts charged four-figure fees, with payments typically routed through Solana wallets. This practice blurs the line between genuine community engagement and paid hype, potentially misleading retail investors.

Regulatory scrutiny is intensifying as these findings suggest artificial inflation of token interest. The leak underscores the need for greater transparency in crypto marketing practices, particularly around influencer compensation and disclosure requirements.

Solana Price Prediction: Bulls Eye $200 Reclamation Amid Bearish Pressure

Solana's price action faces a critical juncture as it struggles to break through the $200 resistance level. On-chain metrics reveal cooling activity, with DEX volumes plunging to mid-2024 lows. The thin liquidity environment raises volatility risks, leaving traders questioning whether this consolidation precedes another leg up or signals a deeper correction toward $180.

Crypto Rover's data shows Solana's decentralized exchange activity has deteriorated sharply, with unique trader counts retreating from earlier peaks. This weakening participation coincides with SOL's repeated failures to hold above $206—a level that's become a battleground for short-term momentum. Market observers now watch whether the network's DeFi contraction will translate into broader price vulnerability.

Solana Governance Advances as Alpenglow Proposal Passes with Overwhelming Support

Solana's ecosystem has reached a pivotal moment with the successful validator-signaling vote for SIMD-326, known as Alpenglow. The proposal, which promises to slash finality times from 12.8 seconds to 150 milliseconds, garnered 99% approval among participating validators. Stake participation hovered at 51% during the voting window spanning epochs 840 to 842.

The protocol's governance mechanism reveals a nuanced power dynamic. While on-chain votes serve as sentiment indicators, ultimate implementation rests with validator coalitions and developer teams like Anza. Their Agave client modifications through feature gates act as the technical gatekeeper for network upgrades.

Improvement proposals follow a rigorous GitHub-based drafting process, allowing community scrutiny before reaching voting stages. This hybrid model blends decentralized input with technical pragmatism—a structure now being tested by Alpenglow's throughput ambitions.

Solana Community Overwhelmingly Approves Historic 'Alpenglow' Upgrade

Solana's ecosystem is poised for a transformative leap after 98.27% of participating stakers voted in favor of the Alpenglow upgrade. The near-unanimous approval signals strong consensus for what may become the network's most significant technical overhaul to date.

The upgrade replaces Solana's foundational Proof-of-History and TowerBFT systems with two novel components: Votor and Rotor. Votor slashes transaction finality from 12 seconds to 150 milliseconds—a 98% reduction that enables near-instant confirmations. Rotor's subsequent implementation will optimize validator data transfers, particularly benefiting high-throughput applications like DeFi and blockchain gaming.

With 52% of stakers participating, the governance process demonstrated robust engagement. The changes address long-standing scalability constraints while maintaining Solana's competitive edge in transaction speed—a critical differentiator in the smart contract platform arena.

Solana Rebounds Above $200 as Traders Anticipate $217 Breakout

Solana has surged past the $200 mark after bouncing off a critical support level at $195, signaling renewed bullish momentum. The rebound comes amid heightened trading activity, with $14 million in inflows suggesting whale accumulation ahead of a potential breakout.

Technical indicators reinforce the upward trajectory. The MACD line has crossed above its signal line, reflecting accelerating buying pressure. Trading volume confirms the move isn't isolated—market participation is broadening as Solana tests higher resistance levels.

All eyes now turn to the $217 resistance level. A decisive break could propel SOL toward the $230-$240 range in September, potentially challenging its mid-May upward channel constraints. The cryptocurrency currently trades at $202.61, having reclaimed key psychological levels at $198 and $200.

Is SOL a good investment?

Based on current technical indicators and market fundamentals, SOL presents a compelling investment opportunity. The cryptocurrency is trading above its key 20-day moving average with strong institutional support at the $200 level. The recent approval of the Alpenglow upgrade and ecosystem development initiatives provide fundamental strength.

| Indicator | Current Value | Signal |

|---|---|---|

| Price | $208.66 | Bullish |

| 20-day MA | $196.45 | Support |

| Bollinger Upper | $217.39 | Resistance Target |

| MACD | -10.67 | Improving |

BTCC financial analyst James suggests that while short-term volatility may persist, the combination of technical strength and positive news flow makes SOL a attractive investment for those with moderate risk tolerance.